Medicare Advantage (MA) is a government-sponsored program that provides an alternative to traditional fee-for-service (FFS) Medicare. This program allows benefits to be delivered to Medicare beneficiaries by private health plans, known as Medicare Advantage Organizations (MAOs). MAOs offer a variety of plan designs with different benefits and premiums. This report focuses specifically on the 2024 DSNP market, which caters to individuals who are eligible for both Medicare and Medicaid. It will explore the value proposition and benefit offerings within this segment of the MA market.

The average benefit provided by D-SNP MA plans is steadily increasing

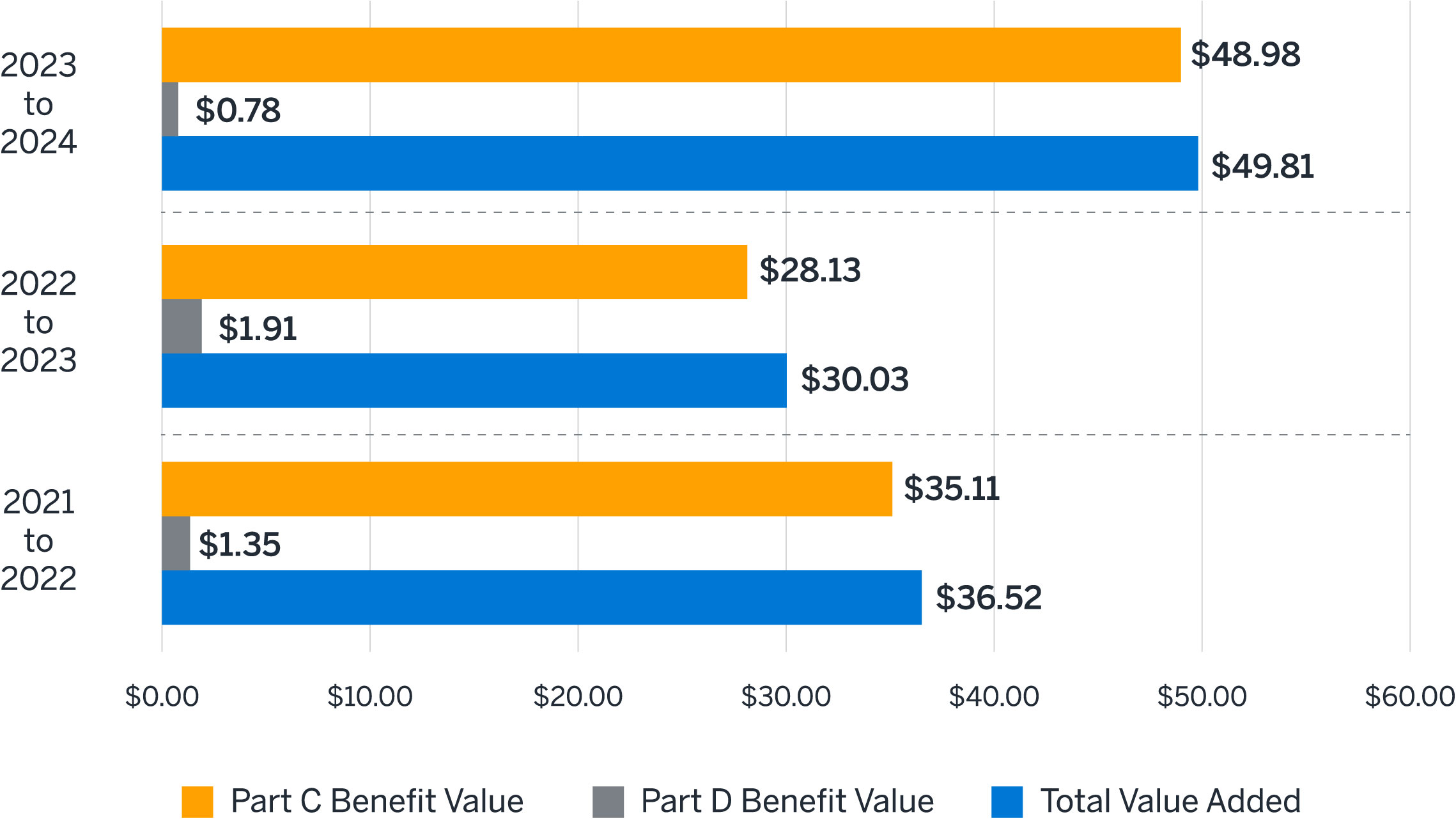

Figure 1 illustrates the average annual growth in total value added,

along with the breakdown of Part C and Part D contributions, from 2021 to 2024.

D-SNP Value on the Rise

The benefits offered by Dual-Eligible Special Needs Plans (D-SNP MA plans) are getting more valuable each year. From 2023 to 2024, the overall value added per member per month (PMPM) jumped to $50, compared to $30-$35 in previous years. This increase is mainly due to improvements in medical benefits (Part C).

Part D Value Added Slows Down

Part D benefits (prescription drugs) in D-SNP plans are showing slower growth. D-SNPs typically offer a standard benefit design, with some plans going beyond the minimum by offering lower co-pays or even no co-pays at all. This “no co-pay” approach, often used through the VBID program, saw a big increase in 2022 and 2023. However, by 2024, most major D-SNP providers already offered this benefit, leading to a smaller increase that year.

Part C Value Added Takes Center Stage

Medical benefits (Part C) are a key focus for D-SNP beneficiaries, and their value is rising significantly. A 2023 regulation changed how out-of-pocket costs are calculated, impacting D-SNP finances. While this may have limited benefit increases in 2023, the trend reversed in 2024. One big driver of this growth is the expansion of “cash-like” benefits, such as money for over-the-counter medications, groceries, and utilities.

D-SNP plans are adding more valuable extras for enrollees

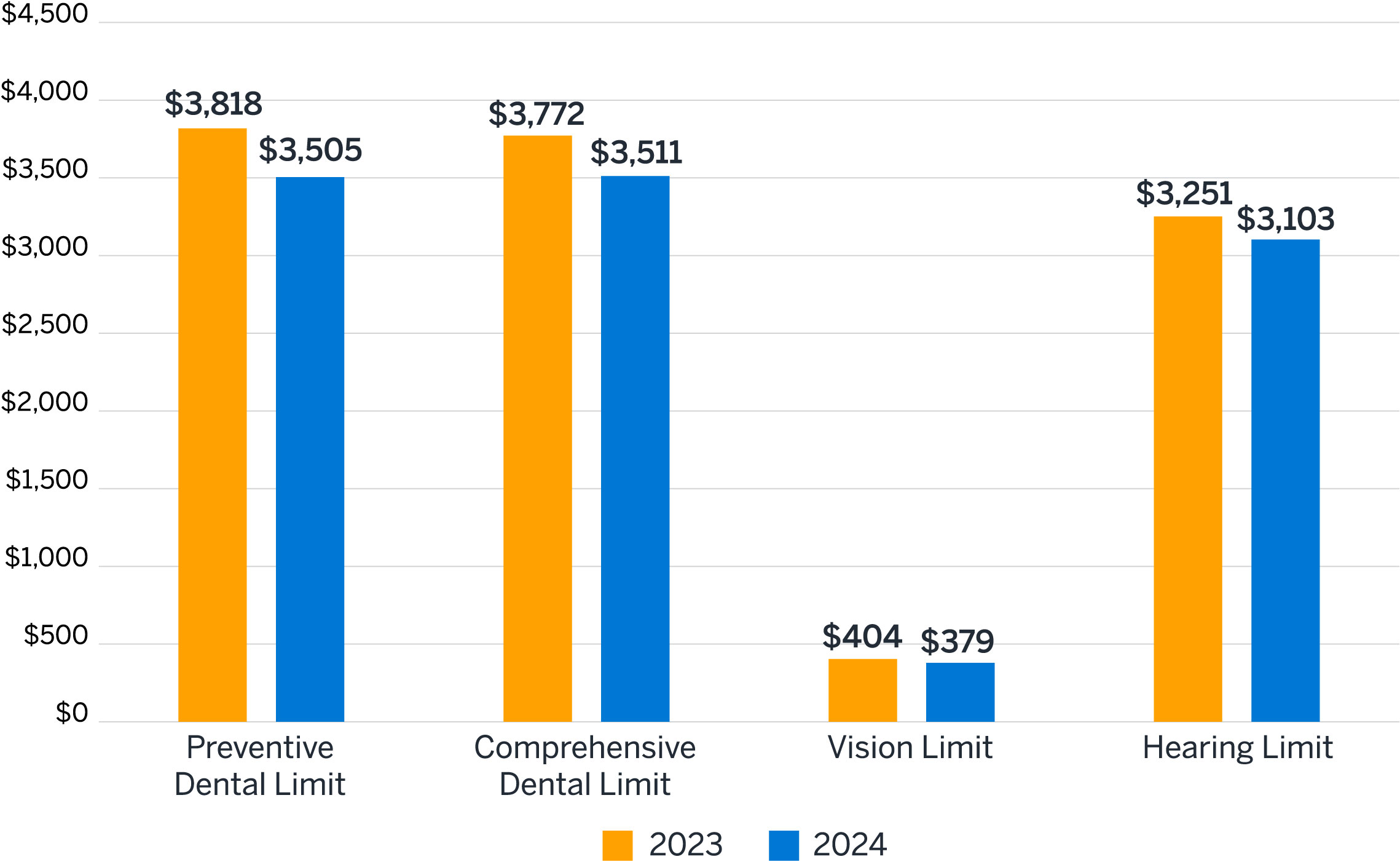

D-SNP plans go beyond traditional Medicare by offering extra benefits like dental, vision, hearing, and OTC coverage. These are mandatory benefits, so all D-SNP plans include them at no extra cost. (Figure 2 shown below). Some plans may even combine preventive and comprehensive dental services into one limit.

Comparison of average annual dental, vision, and hearing

benefit limits for D-SNP MA plans in the years 2023 and 2024.

Shifting Priorities in D-SNP Coverage

While over 90% of D-SNP beneficiaries have dental, vision, and hearing coverage in 2024, the average annual limits for these benefits actually decreased compared to 2023. This could be due to a few reasons:

- Funding other, more recently offered benefits (discussed later).

- Facing general challenges within the Medicare Advantage program.

This trend contrasts with the general Medicare Advantage market, where coverage limits for these services typically increased in 2024.

It’s also worth noting that some D-SNP plans offer separate coverage limits for preventive and comprehensive dental services, while others combine them into a single limit. In 2024, about 57% of D-SNPs opted for the combined approach.

(Next section discusses OTC benefit card limits shown in Figure 3, shown below.)

Figure 3: Showcases the average monthly OTC benefit card limits

for D-SNP MA plans over the span of four years, from 2021 to 2024.

D-SNP Strengthens OTC Coverage:

Unlike the general Medicare Advantage market where OTC benefit limits remained flat, D-SNP plans continued to increase their average monthly limits in 2024, reaching nearly $150. This means D-SNP beneficiaries have access to more funds for over-the-counter medications and other approved health products. It’s important to note that plans have flexibility in how they offer this benefit (monthly, quarterly, annually) and whether any unused funds carry over. Nearly all D-SNP beneficiaries (over 98%) have access to some form of OTC coverage in 2024.

In 2024, the expansion of combined benefit offerings is on the rise

Combined benefits, or “combo” benefits, are designed to include multiple supplemental benefits in one package and may have a total dollar limit across all benefits in the package. Many different combinations of benefits are offered through this design. While shared preventive and comprehensive dental limits fall into the combo benefit category when filed in the plan benefit package (PBP), we do not include them in this discussion—we focus on “true” combo benefits, which include multiple types of unrelated benefit types.

Figure 4: Shows the percentage of D-SNPs in 2023 and 2024 offering specific

benefit combinations for the most common combined benefit structures.

Dental, vision, and hearing benefits are a common combined benefit structure. While the prevalence of dental, vision, and hearing benefits alone decreased from 2023 to 2024, the shift toward plans offering these three benefits plus an OTC benefit card accounts for most of the decrease. A similar trend is observed in the general enrollment market.

Combined benefits including an OTC benefit card increased from 2023 to 2024. About 30% of D-SNPs are combining OTC with a VBID or Special Supplemental Benefits for the Chronically Ill (SSBCI) offering in 2024, which is often either a food and/or utilities benefit. One large national carrier is offering plans that include OTC combined with home and bathroom safety devices in 2024, which is driving the significant increase in the ”OTC and Other” category from 2023 to 2024 (and which applies to the general enrollment market as well). Other benefits often combined with OTC include dental, vision, hearing, fitness, and transportation.

The percentage of beneficiaries with at least one true combo increased over 20 percentage points, from 65% to 86% from 2023 to 2024. The largest increase in true combined benefit prevalence occurred from 2021 to 2022, with an increase from 8% to 52%. This significant increase of true combo benefit prevalence in the D-SNP market indicates plans now consider combined benefits table stakes in the D-SNP market and believe members find value in benefits allowing choice and flexibility. As combo benefits become more prevalent in the MA market, member understanding of how these designs work and how to use them may improve as well, leading to increased utilization of these benefits.

Non-uniformly offered benefit offerings through

the VBID program are table stakes for D-SNPS

VBID Takes Center Stage for D-SNP Supplemental Benefits

Medicare Advantage Organizations (MAOs) offer supplemental benefits to enrollees. Traditionally, these benefits were based on health conditions (SSBCI). However, the VBID program allows MAOs to tailor benefits based on both health and socioeconomic factors. In the 2024 D-SNP market, VBID emerged as the dominant approach for offering these additional benefits, while SSBCI participation declined. This suggests VBID’s flexibility in considering socioeconomic factors is increasingly valued.

Figure 5: Trends in VBID, SSCBI, and Select Benefit

Flexibilities for D-SNP MA Plans over the Past Four Years.

More D-SNP Choices with Extra Benefits

Picking a D-SNP plan just got easier. Now, almost everyone in a D-SNP (93%) gets help with their medications through a program called VBID. This program is becoming more popular than the older way (SSBCI) of offering extra benefits based on health conditions.

D-SNP plans are also offering more benefits to compete. Nearly everyone (around 90%) can now get help with groceries, utilities, and even eliminate prescription drug costs entirely. These benefits are becoming increasingly important for D-SNP plans to stay competitive.

Data & Methods

This analysis is based on detailed information about Medicare Advantage (MA) plans released by the Centers for Medicare and Medicaid Services (CMS). This includes plan benefits, premiums, and enrollment data.

- Enrollment data: Utilized was February enrollment figures for most years, except for 2024 where September 2023 data was adjusted to estimate enrollment for 2024.

- Benefit value estimation: Milliman’s internal pricing models were used to estimate the value of Part C (medical) and Part D (prescription drug) benefits. This includes the 2024 Milliman MACVAT® tool, which is commercially available. These models consider factors like county-specific costs and typical patient populations.

The integrated data with plan-specific details obtained from CMS, such as premiums and benchmark revenue organized by county. This integration facilitated the calculation of the added value for each plan.

What We Didn’t Analyze

This analysis focused specifically on D-SNP plans. It excluded other types of Medicare plans like general enrollment plans, Chronic SNPs (C-SNPs), Institutional SNPs (I-SNPs), Prescription Drug Plans (PDPs), and others; also excluded territories outside the U.S. mainland.

The future looks more uncertain for

D-SNP plans in 2025 due to rising cost pressures

D-SNP Market Thrives, But Change is Coming

The D-SNP market continues to flourish, with the number of plans nearly doubling since 2019 and growing another 4% in 2024. National organizations are also voicing strong support for D-SNPs’ continued growth. However, significant changes are likely in 2025 due to factors like the Inflation Reduction Act (IRA), proposed regulations, and evolving risk models. These will likely lead to adjustments in D-SNP benefit designs.

Navigating the Future

Understanding the local market and how competitors adapt to these changes will be crucial for Medicare Advantage Organizations (MAOs) and other stakeholders. By effectively analyzing these shifts in relation to their own goals, MAOs can be better positioned to navigate the upcoming challenges in 2025.

CMS. Medicare Advantage Value-Based Insurance Design Model. Retrieved January 9, 2024, from https://www.cms.gov/priorities/innovation/innovation-models/vbid.

The full text of the final rule is available at https://www.federalregister.gov/documents/2022/05/09/2022-09375/medicare-program-contract-year-2023-policy-and-technical-changes-to-the-medicare-advantage-and.

Laktas, J., Yeh, M., & Friedman, J.M. (March 21, 2023). Prevalence of Supplemental Benefits in the D-SNP Medicare Advantage Marketplace: 2019 to 2023. Milliman White Paper. Retrieved January 9, 2024, from https://www.milliman.com/en/insight/prevalence-supplemental-benefits-d-snp-medicare-advantage-marketplace-2023.

Murphy-Barron, C.M., Pelizzari, P.M., & Regan, B. (February 2019). The Medicare Advantage Value-Based Insurance Design Model: Overview and Considerations. Milliman White Paper. Retrieved January 9, 2024, from https://www.milliman.com/en/insight/the-medicare-advantage-value-based-insurance-design-model-overview-and-considerations.

Freed, M. et al. (November 15, 2023). Medicare Advantage 2024 Spotlight: First Look. KFF. Retrieved January 9, 2024, from https://www.kff.org/medicare/issue-brief/medicare-advantage-2024-spotlight-first-look/.

Kelly, L.F. (December 21, 2023). Investor Day Roundup: Centene, CVS, United See Promise of Duals Market in 2024 and Beyond. AIS Health. Retrieved January 9, 2024, from https://aishealth.mmitnetwork.com/blogs/radar-on-medicare-advantage/investor-day-roundup-centene-cvs-united-see-promise-of-duals-market-in-2024-and-beyond.

SUBSCRIBE TO OUR E-MAIL LIST

to STAY UPDATED!

Embark on the path to success alongside over 3,000 agents. Enroll in our email list now and ensure you stay at the forefront, receiving top-notch insurance tips, lead sources, carrier highlights, industry news, and much more!